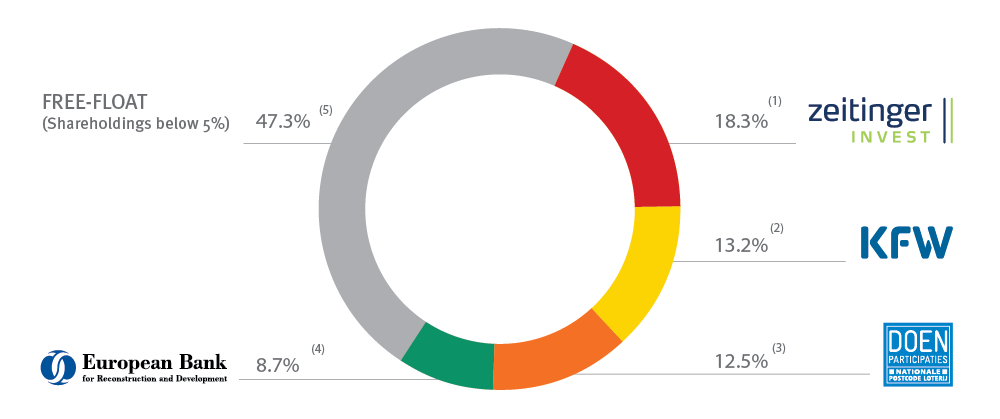

Shareholder structure

1) According to information voluntarily reported by Zeitinger Invest on 13.04.2023 (see section “Other information” on the IR website of ProCredit Holding)

2) According to information voluntarily reported by Kreditanstalt für Wiederaufbau (KfW) on 17.04.2023 (see section “Other information” on the IR website of ProCredit Holding)

3) According to information voluntarily reported by DOEN Participaties on 14.04.2023 (see section “Other information” on the IR website of ProCredit Holding)

4) According to the voting rights notifications as of 23.05.2023

5) As a result of the TIAA Board of Governors’ voting rights notification as of 24.07.2025, the free float increased to 47.3%

The shareholder structure presented above is based on the public voting rights notification by EBRD and, in the case of Zeitinger Invest GmbH, Kreditanstalt für Wiederaufbau (KfW) and DOEN Participaties B.V., on the voluntary disclosure of voting rights (see “Voting rights notifications” and “Other information” in the Investor relations section of the ProCredit Holding website). This breakdown was calculated by comparing the numbers of voting rights reported by the shareholders on the above-mentioned dates against the total number of voting rights (currently 58,898,492). ProCredit Holding AG has made reasonable efforts to provide a realistic overview of the shareholder structure. However, due to limitations on the availability and verifiability of the underlying data, ProCredit Holding AG does not assume any responsibility that the information presented here is accurate, complete and up to date.