Environmental standards

Minimising our negative impact on the environment and proactively promoting a sustainable way of doing business is an integral part of our business strategy – not only in connection with our lending operations or the provisioning of financial services to our clients, but also in our own day-to-day operations.

We adhere to the following key principles to continuously improve our environmental performance:

Our performance

- Identify environmental aspects and impact of our business activity

- Develop and implement measures to mitigate negative environmental impact

- Use resources as efficiently as possible

- Ensure compliance with relevant legislation and international standards

- Raise awareness regarding environmental and social issues among our staff

- Minimise the negative environmental and social impact of our lending operations

- Encourage our clients to invest in an environmentally sound manner

- Seek to work with suppliers who conduct their business in line with our environmental and social standards; engage in communication to positively influence the environmental and social impact of our suppliers’ products and/or operations

Our vision of development entails social and environmentally conscious management, the dissemination of technologies and knowledge and the creation of jobs. This is why we support businesses which, like us, have realised that economic growth should not be achieved at the expense of the environment.

To accomplish this, we have developed and implemented a comprehensive environmental management system (EMS) that is based on three pillars. Not only does it aim to reduce both the internal and external environmental impact of the ProCredit group, it also promotes loans and investments that have a positive impact on the environment.

Environmental Management in the ProCredit Group

Pillar I

Internal environmental management

Our internal processes and procedures are designed to systematically reduce our direct environmental footprint. Greening the banks’ infrastructure and communicating about environmental issues raises awareness in our institutions and leads to improved resource consumption.

Pillar II

Management of environmental and social risk in lending

We aim to work with businesses whose activities do not harm the environment or endanger the health, safety and well-being of their staff or neighbours. By applying a prudent credit risk approach, we minimise possible negative impacts of our lending operations on the environment.

Pillar III

Green lending

We promote green investments and savings in our countries of operation. We engage with our clients to promote sustainable practices and support their decarbonisation and transition towards environmentally responsible operations by investing in energy efficiency, renewable energies or environmental protection.

You can learn more about our EMS and our results achieved so far here.

The key to successful implementation of our EMS is anchoring it within our institutions

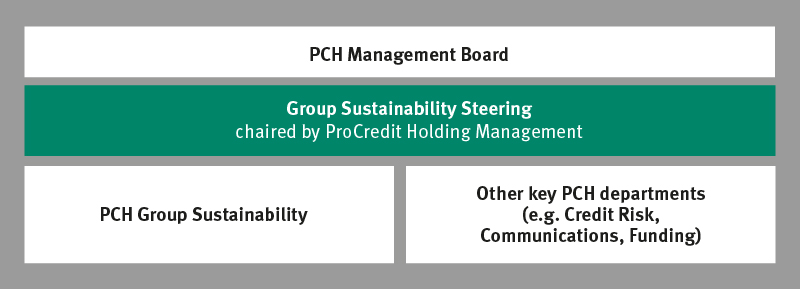

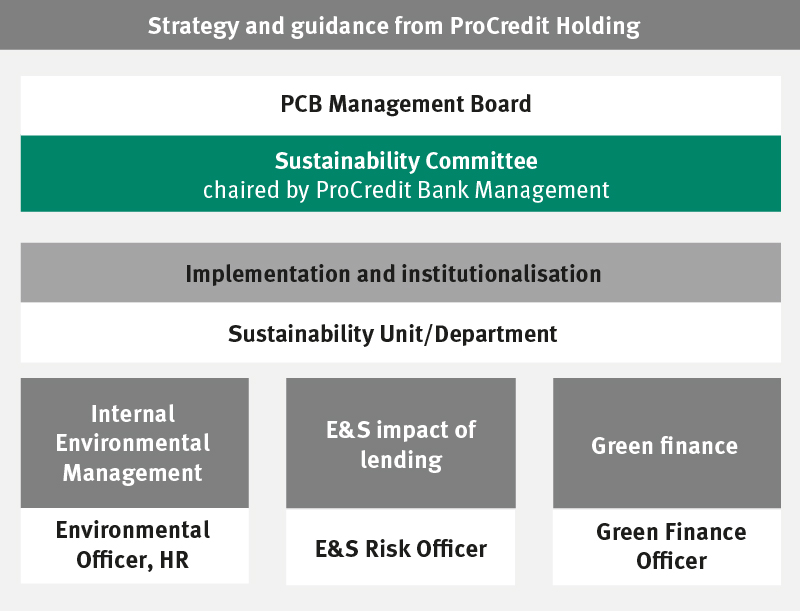

As the graphs below show, strategic decisions regarding the EMS are taken by the Group Sustainability Steering Committee and implemented by the Group Sustainability Management team, which also facilitates the introduction and expansion of the EMS in all our banks. At the bank level, the individual environmental committees are responsible for all strategic decisions. Coordinators are assigned by the banks for each pillar in order to ensure the full institutionalisation of the EMS.

Environmental Management System at group level

Environmental Management System at bank level

Strengthening and further developing our EMS requires significant staff involvement and participation at all levels of the ProCredit group. Therefore, continuous staff training, internal awareness raising and in-house expertise are key components of our business philosophy in general and our environmental management approach in particular.

As part of our efforts to continuously improve our environmental management performance, the ProCredit banks have either already obtained or are in the process of obtaining certification of conformity with the international standard ISO 14 001. In addition, the four ProCredit institutions located in Germany, i.e. ProCredit Holding AG, ProCredit Bank AG, ProCredit Academy GmbH and Quipu GmbH, have obtained Eco-Management and Audit Scheme (EMAS) validation of their environmental management systems.