Business ethics and environmental standards

As a development-oriented commercial group of banks, we continuously evaluate the relevance of our actions with regard to our concept of development, which goes well beyond the traditional notion of economic growth. Rather, it is related to a broader sense of responsibility towards the countries in which we operate.

We as the ProCredit group continuously assess our actions and decisions, not only from the perspective of profitability and our clients’ needs, but also and above all against the impact they might have on society and the environment around us.

In this respect, we take part in various initiatives, such as:

UN Environment Programme Finance Initiative (UNEP FI)

ProCredit Holding AG is a member of the UN Environment Programme Finance Initiative (UNEP FI) and shares its Principles for Responsible Banking. Additionally, under the same initiative, ProCredit Holding participates in the Finance Leadership Group on Plastics.

Net-Zero Banking Alliance (NZBA)

This industry-led, UN-convened alliance of banks worldwide is committed to aligning their lending and investment portfolios with net-zero emissions by 2050 or sooner. This is in accordance with the most ambitious targets set in the Paris Climate Agreement.

Science Based Targets initiative (SBTi)

The ProCredit group has committed to set its future near- and long-term emissions reductions in accordance with the Science Based Targets initiative (SBTi) Net-Zero Standard, as part of the Business Ambition for 1.5°C and the UNFCCC Race to Zero campaign.

The Science Based Targets initiative (SBTi) has validated ProCredit Holding’s near-term targets as science-based. The group is thus committed in the near term to reducing its Scope 1 and 2 emissions by 42% as well as to engaging with the clients responsible for 28% of portfolio emissions to set their own science-based targets and to continue financing only renewable energy projects.

2X Global

The institution joined 2X Global, a global membership and field-building organisation that brings together different actors from the financial industry with the aim of advancing intersectional investment agendas and facilitating capital deployment through gender-smart investing.

United Nations Global Compact (UNGC)

Participation in the United Nations Global Compact (UNGC) for sustainable and responsible corporate governance underscores our commitment to strategically anchoring sustainability and to contributing to the implementation of the SDGs through the adoption of the ten principles of the UN Global Compact.

Partnership for Carbon Accounting Financials (PCAF)

As part of our efforts to assess the Scope 3 emissions stemming from our loan portfolio as well as to quantify climate risks and limit our impact on climate change, the ProCredit group has set itself the task of measuring and disclosing the greenhouse emissions associated with its lending activities and investments in accordance with the Partnership for Carbon Accounting Financials (PCAF) standards.

Joint Impact Model (JIM)

Aiming to achieve comparability, accountability, and transparency in the measurement of key impact indicators in a harmonised manner, the ProCredit group joined the JIM and began quantifying indirect jobs and value added of its investments.

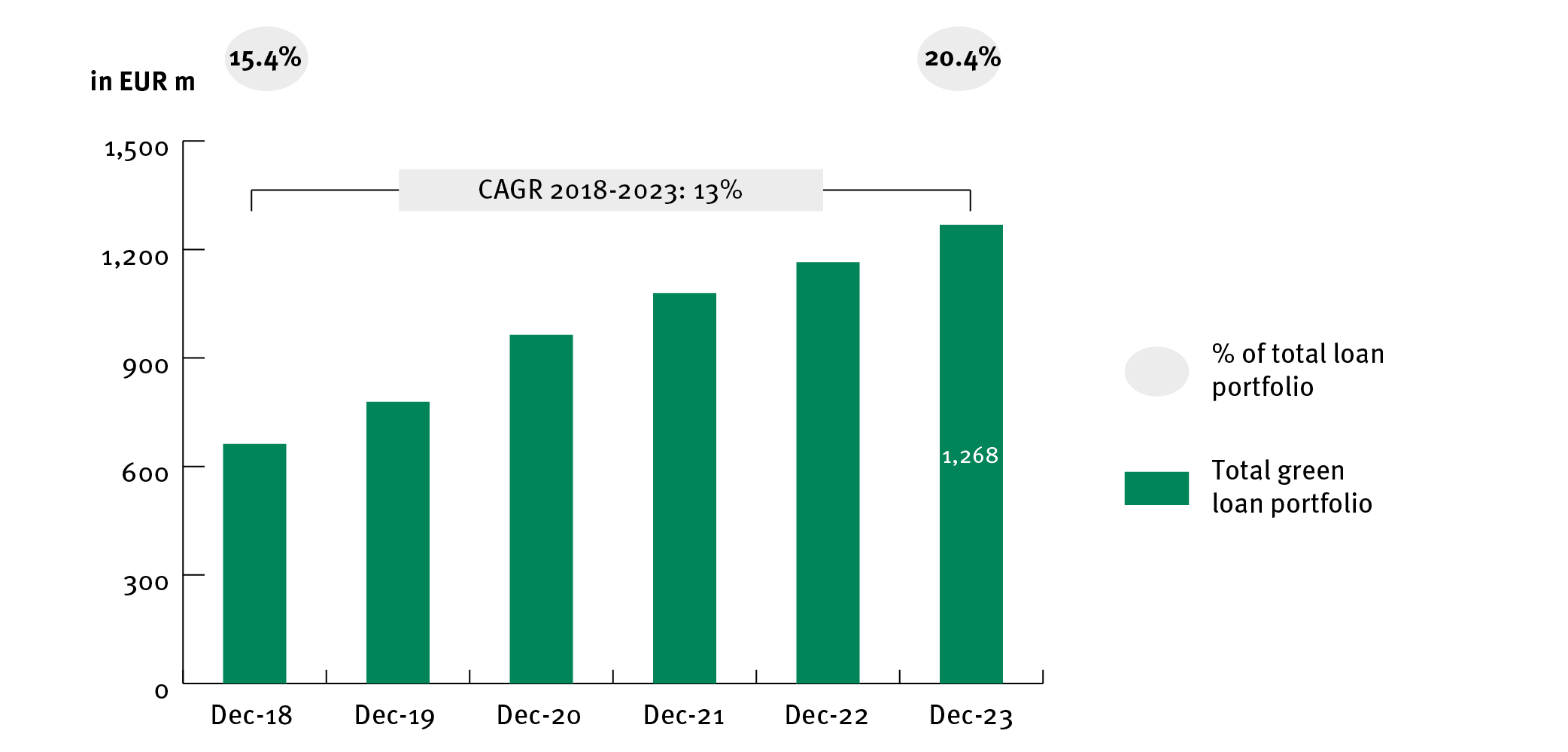

Our results in green finance

With our accumulated in-house expertise, we are perceived as pioneers in the countries in which we operate and our banks have positioned themselves as the partner of choice for green loans. Close cooperation with our clients allows us to understand and support them in their businesses. And, by bringing environmentally concerned businesses together, we provide a forum for discussion, knowledge-sharing and the exchange of ideas and best practices among our client group.

ProCredit group green loan portfolio development

Note: Continuing operations as per 31-Dec-2023

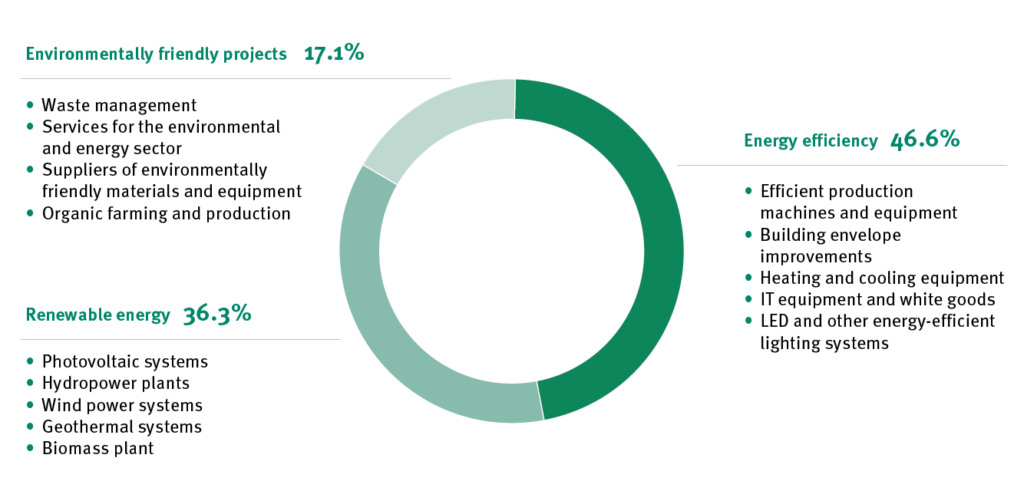

Green loan portfolio by investment type

Note: As per 31-Dec-2023

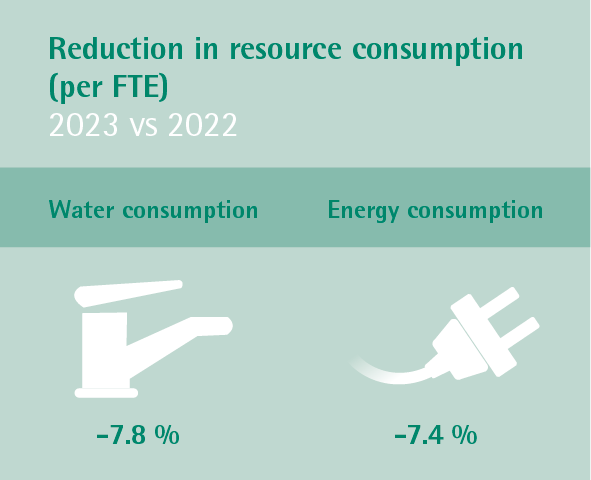

Our performance and external certification

In August 2022, all ProCredit institutions based in Germany were re-certified under the EU Eco-Management and Audit Scheme (EMAS) and ISO 14001:2009. The first certification was issued in 2016.